ADA Price Prediction: Technical Analysis Suggests Potential Rally to $1.05 Amid Strong Network Fundamentals

#ADA

- Technical Momentum: Positive MACD divergence and Bollinger Band positioning suggest strengthening bullish momentum with key resistance at $0.9545

- Network Fundamentals: $5.3 billion network volume indicates robust ecosystem activity and growing adoption supporting price appreciation

- Market Sentiment: Overall positive outlook with targets toward $1.05, though whale selling requires monitoring for potential short-term pressure

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Despite Short-Term Pressure

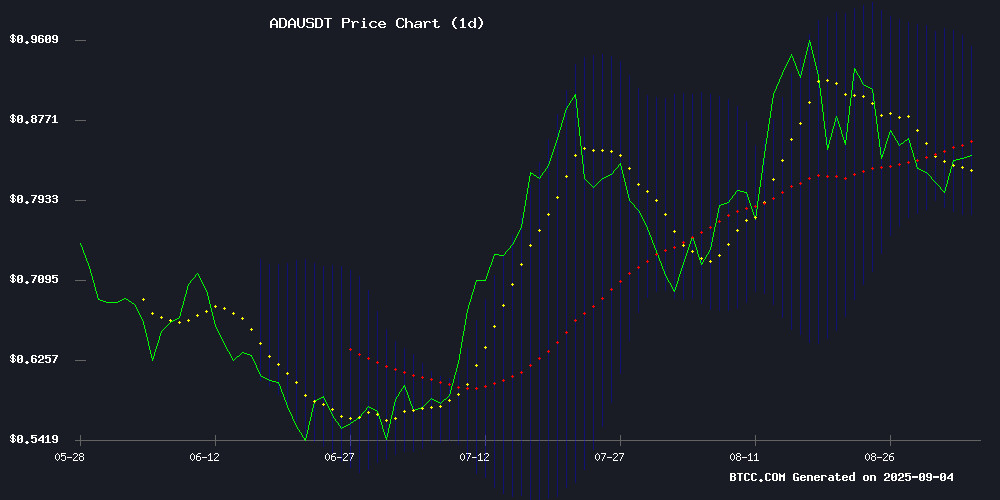

According to BTCC financial analyst Mia, ADA is currently trading at $0.8364, below its 20-day moving average of $0.866. The MACD indicator shows positive momentum with a value of 0.0298, significantly above the signal line at 0.0087, indicating strengthening bullish momentum. The Bollinger Bands suggest ADA is trading NEAR the lower band at $0.7776, which could present a potential buying opportunity if support holds.

Mia notes that the current technical setup suggests consolidation with an upward bias, with key resistance at the upper Bollinger Band of $0.9545. A break above this level could signal further upside potential toward the $1.00 psychological level.

Market Sentiment: Positive Outlook Driven by Network Growth and Technical Breakout Potential

BTCC financial analyst Mia comments that recent news headlines reflect growing Optimism around Cardano's fundamentals. The network volume reaching $5.3 billion indicates strong ecosystem activity, while technical analysis suggests a potential 25% rally toward $1.05. However, Mia cautions that whale selling activity mentioned in some reports could create short-term volatility during the consolidation phase.

The overall sentiment remains constructive, with market participants eyeing the crucial $1.00 breakout level. Successful consolidation above this threshold could validate the bullish technical setup and attract additional institutional interest.

Factors Influencing ADA's Price

Cardano (ADA) Eyes $1.05 Target as Technical Setup Signals 25% Rally Potential

Cardano's ADA is showing bullish momentum, with technical analysis suggesting a potential 25% rally to $1.05 by mid-October 2025. The cryptocurrency broke key moving averages, with immediate resistance at $0.95 and support holding firm at $0.78.

Analyst projections diverge sharply, ranging from conservative $0.82-$1.05 targets to aggressive $2.47-$2.63 forecasts for 2025. The $1.00-$1.05 zone emerges as a consensus technical target, representing 20-25% upside from current $0.84 levels.

Market dynamics indicate institutional accumulation may be building toward this resistance cluster. Bollinger Band analysis shows upper resistance at $0.95, while breakout patterns suggest sustained upward momentum if key levels hold.

Cardano Price Eyes $1 Breakout as Network Volume Hits $5.3B

Cardano's network volume surged to $5.3 billion last week, marking one of its strongest performances in 2025. Analysts highlight a potential breakout toward $1.00 if key support levels hold, with ADA currently stabilizing at $0.80 after a period of consolidation.

Technical indicators suggest weakening bearish momentum, as noted by market analyst Mr. Brownstone. A bullish divergence on the MACD indicator points to upward potential, with resistance near $0.85. A close above this level could pave the way for a rally to $1.00.

Network activity reinforces the bullish case, with Cardano processing over $5 billion in transactions. The $0.68 support remains critical—any breakdown below this level would undermine the current recovery narrative.

Cardano Price Prediction: Whale Selling Tests Bulls as ADA Consolidates for a Recovery Towards $1.00

Cardano is regaining market attention as analysts identify bullish technical signals and surging on-chain activity. ADA currently hovers near $0.81, forming what appears to be a bottoming pattern after a steady pullback from recent highs. The $0.68 support level remains critical for maintaining bullish momentum.

Technical analyst Mr Brownstone notes a bullish divergence on the MACD indicator, suggesting weakening bearish pressure. A breakout above near-term resistance at $0.85 could pave the way for a rally toward $1.00. Meanwhile, Cardano's network activity shows remarkable strength, processing $5.3 billion in on-chain volume during its strongest week of 2025.

Is ADA a good investment?

Based on current technical indicators and market sentiment, ADA presents a compelling investment opportunity for risk-tolerant investors. The cryptocurrency is currently trading at $0.8364, showing bullish MACD momentum while testing support levels. Key factors supporting investment consideration include:

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $0.8364 | Consolidating |

| 20-day MA | $0.8660 | Slight resistance |

| MACD | 0.0298 | Bullish |

| Bollinger Upper | $0.9545 | Key resistance |

| Bollinger Lower | $0.7776 | Support level |

BTCC analyst Mia suggests that while short-term volatility may persist due to whale activity, the technical setup supports a potential move toward $1.05, representing approximately 25% upside from current levels. Investors should monitor the $1.00 breakout level and consider dollar-cost averaging to manage risk.